News

EUROPEAN SECURITIES AND MARKETS AUTHORITY - Following his appointment to the influential body, the VZMD President participated actively for the first time at the meeting of the Corporate Finance Standing Committee in Paris

LUXEMBOURG - The reasoned opinion published today by the Advocate-General of the European Court of Justice reaffirm the arguments made by VZMD and the expropriated investors

At today's second public hearing in the case "Kotnik and others" which took place at the European Court of Justice in Luxembourg due to the expropriation of shareholders and bondholders of Slovenian banks , the Advocate-General of the Court published his reasoned opinion in which he proposed the explicit answers to the questions posed by the Constitutional Court of the Republic of Slovenia, stating that the expropriation of the shareholders and bondholders of Slovenian banks was neither necessary nor unavoidable for the stabilization of the banking system and allocation of state aid.

After reviewing the Advocate-General's reasoned opinion, VZMD's associates and lawyers can repeat with reinforced certainty their position that it was not necessary for the Republic of Slovenia to amend the Banking Act as to allow for retroactive expropriation, since the Banking Communication is not a legally binding act on the EU member states. It has to be noted that the court in Luxembourg does not assess the conformity of legislation with the Convention on Human Rights, as this falls under the jurisdiction of the Constitutional Court of the Republic of Slovenia and the European Human Rights Court in Strasbourg. Nevertheless, it clearly arises from the reasoned opinion that the Constitutional Court of the Republic of Slovenia will have to reach a decision itself assessing whether amendment of the Banking Act constituted a breach of the Constitution of the Republic of Slovenia. Namely, the Slovenian courts must assess the content to determine whether the exceptional measures of the Bank of Slovenia were legitimate or not, taking into consideration all the protective regulation prohibiting the violations of ownership rights which the VZMD believes were severely infringed.

EU Commission & Slovenian Government - European warnings due to detrimental consequences of expropriation and a call to resolve the untenable situation as soon as possible

The European Federation of Investors and Financial Services Users (Better Finance) has addressed an open letter to the Government of the Republic of Slovenia and the EU Commission noting the issue of complete expropriation cancellation of subordinated bonds from six Slovenian banks.

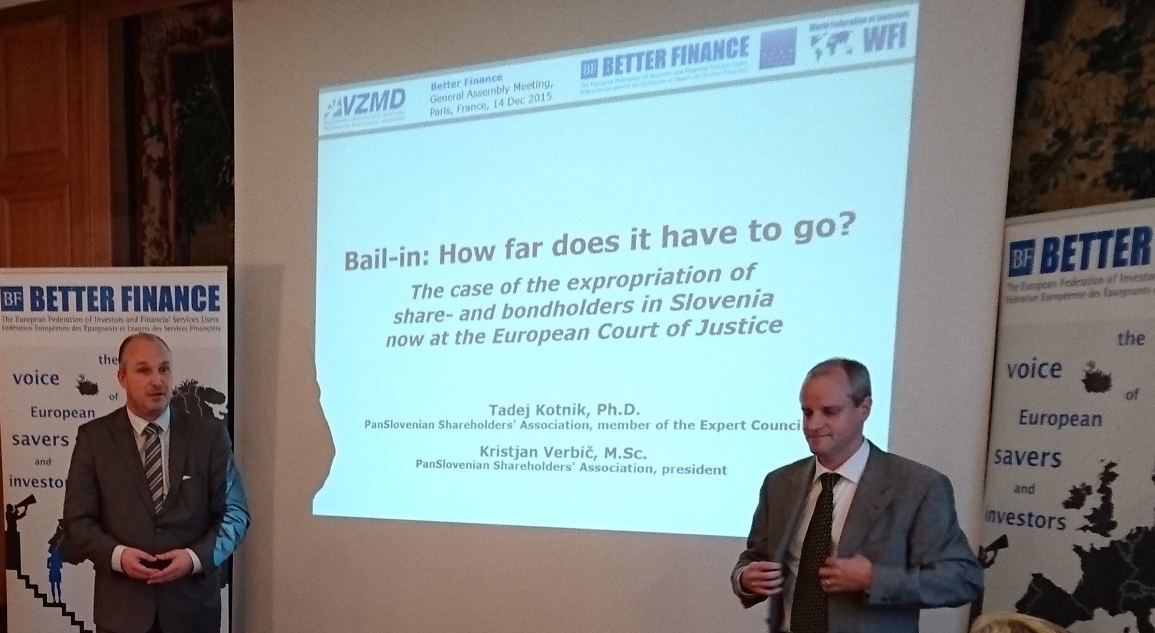

The letter follows an extensive discussion held by the Better Finance's General Meeting in November in Paris when a member of the VZMD Expert Council, Mr. Tadej Kotnik, and VZMD President, Mr. Kristjan Verbič, presented the scandalous expropriation of shareholders and bondholders of Slovenian banks, "Bail-in: How far does it have to go?" (presentation).

In its letter, Better Finance President, Mr. Jean Berthon, underlined the fact that some of the canceled bonds had been sold to individual investors over the bank counters as an alternative to deposits, while the brochure, which had been certified by the Securities Market Agency (ATVP), claimed that the risk of loss only existed if bankruptcy proceedings were initiated against a particular bank. Bonds were traded publicly also at the Ljubljana Stock Exchange and trading was in no way limited only to "well-informed" investors.

This intolerable situation in Slovenia has been going on for over two years, and Better Finance pointed out that during this time several bank "bail-ins" happened in the EU, but these proceedings were also completed - either by an investor settlement or settlement negotiations are already underway.

Since the Republic of Slovenia has not begun any such activities yet, Better Finance pointed out with deep concern that persisting on this kind of attitude toward expropriated investors and savers will have adverse consequences on the Slovenian investment atmosphere and the perception of the business and economic environment in the Republic of Slovenia.

Due to the above, Better Finance urged the European Commission and the Government of Republic of Slovenia in particular, to immediately examine the possibilities to resolve this untenable situation and begin settlement proceedings as soon as possible.

Due to the above, Better Finance urged the European Commission and the Government of Republic of Slovenia in particular, to immediately examine the possibilities to resolve this untenable situation and begin settlement proceedings as soon as possible.

Better Finance's letter was sent last week to European Commission President, Mr. Jean-Claude Juncker, European Commission Vice-President for Jobs, Growth, Investment and Competitiveness, Mr. Jyrki Katainen, Commissioner for Financial Stability, Financial Services and Capital Markets Union, Mr. Jonathan Hill, the Prime Minister of the Republic of Slovenia, Mr. Miro Cerar, and the Finance Minister of the Republic of Slovenia, Mr. Dušan Mramor. A courtesy copy was also sent to VZMD President, Mr. Kristan Verbič, who is also a member of Better Finance's Executive Board.

The European Federation of Investors and Financial Services Users of which VZMD has been a full member since its foundation, is an European non-governmental organization bringing together over 50 national and international associations representing the interests of shareholders, individual investors, and other financial services users.

BANKIA - a success of Spanish minority shareholders encourages also the expropriated share and bond owners in Slovenia - invitation to obtain compensation

In a decision that could affect tens of thousands of investors in Spain, the Supreme Court has ruled that Spanish Bankia has to reimburse two plaintiffs who invested 9,997 € and 20,868 € respectively when the bank was floated. This will probably pave the way for other investors who lost money on their investments to pursue legal action, and Bankia has already put aside over 1.8 billion € for this contingency.

The Bankia case is reminiscent of the Slovenian NKBM case. In 2011 Bankia shares were offered to investors and due to the government's encouragement and assurances, the shares were mostly purchased by domestic inexperienced investors, who bought them with the pension saving purposes.

GRAND CAYMAN - Alternative Investment Summit 2016 and the beginning of this year's 2nd tour of the international business-investor programs of the PanSlovenian Shareholders' and Investors' Association (VZMD)

Following successful completion of the "Slovenian Center" project during the European Handball Championship in Wroclaw, Poland, (VIDEO), this February marks the beginning of this year's 2nd tour of the international business-investor programs of VZMD: Invest to Slovenia – investo.si and International Investors' Network – invest-to.net. These days the island of Grand Cayman is the venue of the important conference Alternative Investment Summit 2016, which is also attended by the VZMD President, Mr. Kristjan Verbič, at the special invitation by one of the event partners.

The prestigious conference at the eminent Ritz-Carlton hotel entitled "Supercharging Alternative Investments in an Age of Uncertainty", was opened by the Prime Minister of the Cayman Islands, Mr. Alden McLaughlin. The events, with Dart Enterprises, KPMG, the Ritz-Carlton and Deutsche Bank as their principal partners, are attended by the most prominent investment bankers and enterprise representatives such as: The Blackstone Group, Apollo Global Management, Aberdeen Asset Management, Highland Capital Management, Arbiter Partners Capital Management, Global Health Investment Fund, Darsana Capital Partners etc.

Apart from interesting developments at the conference, which has become a renowned platform for innovative thinking about alternative investments in the past three years, Mr. Verbič also attended the evening's reception by the renowned law firm Mourant Ozannes.

The tour continued in London, where Mr. Verbič was invited to the grand conference celebrating the fifth anniversary of the European Banking Authority – EBA.

EXCLUSIVE VIDEO REPORT from Wroclaw - 4 days of exceptional opportunities in »Slovenian Center«, juncture for business, investment and promotional interests

Alongside the European handball championship matches, which are this year taking place also in the Polish regional capital city of Wroclaw, several important business and social events took place within the "Slovenian center - I feel Slovenia" (VIDEO). In addition to the members of the Slovenian handball team, high representatives of Poland and Slovenia, and prominent economic delegations from both countries, the opening of the center was attended also by exceptional Slovenian supporters who created an extremely positive atmosphere.

Within the "Business opportunities between Slovenia and Poland" conference, opened by the Minister for Economic Development and Technology, Mr. Zdravko Počivalšek, Slovenia's tourist, sport and cultural attractions, as well as some examples of best practices and additional possibilities for strengthening economic relations and business cooperation were presented. The conference was followed by B2B meetings by both business delegations where great interest was shown for expanding and strengthening the collaboration in future.

SLOVENIAN CENTER IN WROCLAW - large attendance and numerous opportunities for Slovenia's promotion, as well as promising business collaborations, also within the VZMD's business-investor programs and the premiere of its PRESENTATIONAL VIDEO

In the important Polish regional capital city of Wroclaw the grand opening of the "SLOVENIAN CENTER – I FEEL SLOVENIA" took place on Sunday. Much like the national team's matches at the European handball championship, the center worked towards Slovenia's promotion as it combines the country's sports, business, investment and promotional interests. The opening and reception of the president of the Handball Association of Slovenia, Mr. Franjo Bobinac, was attended by members of the Slovenian handball team, organizers, business people, partners and supporters.

In the important Polish regional capital city of Wroclaw the grand opening of the "SLOVENIAN CENTER – I FEEL SLOVENIA" took place on Sunday. Much like the national team's matches at the European handball championship, the center worked towards Slovenia's promotion as it combines the country's sports, business, investment and promotional interests. The opening and reception of the president of the Handball Association of Slovenia, Mr. Franjo Bobinac, was attended by members of the Slovenian handball team, organizers, business people, partners and supporters.

The Slovenian Center, under the auspices of the President of the Republic of Slovenia, Mr. Borut Pahor, was jointly established by the Handball Association of Slovenia, the Ministries of the Economy and Foreign Affairs, the Chamber of Commerce and Industry of Slovenia, the Slovenian Tourist Board, SPIRIT Slovenia, Triglav-Rysy Business Club and the VZMD. The VZMD opted for active engagement in Wroclaw due to its successful participation in the highly visible Slovenian Center during the World Handball Championship in Qatar in January last year. In addition, the VZMD has had valuable experiences in collaboration with the Polish retail investors association, the WSE and many other Polish business entities and institutions. They have maintained an active presence for seven yearsat importantinternational business events in Poland and, moreover, in 2011, organized a special Slovenian Day at the Warsaw Stock Exchange.

The Slovenian Center, under the auspices of the President of the Republic of Slovenia, Mr. Borut Pahor, was jointly established by the Handball Association of Slovenia, the Ministries of the Economy and Foreign Affairs, the Chamber of Commerce and Industry of Slovenia, the Slovenian Tourist Board, SPIRIT Slovenia, Triglav-Rysy Business Club and the VZMD. The VZMD opted for active engagement in Wroclaw due to its successful participation in the highly visible Slovenian Center during the World Handball Championship in Qatar in January last year. In addition, the VZMD has had valuable experiences in collaboration with the Polish retail investors association, the WSE and many other Polish business entities and institutions. They have maintained an active presence for seven yearsat importantinternational business events in Poland and, moreover, in 2011, organized a special Slovenian Day at the Warsaw Stock Exchange.

EUROPEAN HANDBALL CHAMPIONSHIP 2016 - along with the upcoming sport spectacle and as part of the "SLOVENIAN BUSINESS CENTER" in the Polish city of Wroclaw, the presentation of the partners of the business-investor programs of VZMD will be superbly provide

This weekend will mark the beginning of the European handball championship in the important regional Polish capital city of Wroclaw, at which the recognizability of Slovenia will, apart from the national team matches, be also provided for by the "SLOVENIAN CENTER – I FEEL SLOVENIA". The center will represent an exceptional juncture of business and social gatherings which will combine sports, business, investment and promotion interests. Under the aegis of the President of the Republic of Slovenia, Mr. Borut Pahor, the Slovenian Center will be established together by the Handball Association of Slovenia, Ministries of the Economy and Foreign Affairs, Chamber of Commerce and Industry of Slovenia, Slovenian Tourist Board, SPIRIT Slovenia, and PanSlovenian Investors' & Shareholders' Association (VZMD).

The Slovenian Center at the eminent Monopol hotel will be - apart from many high representatives of Slovenia, among which are the Prime Minister of the Republic of Slovenia, Mr. Miro Cerar, and the Minister of the Economic Development and Technology, Mr. Zdravko Počivalšek - also visited by the prominent Slovenian economic delegation.

In addition to the opening of the Slovenian Center, the delegation members will also attend the reception which will be hosted by the Chairman of the Handball Association of Slovenia Mr. Franjo Bobinac, where the Prime Minister of Slovenia will be the guest of honor. As part of the business event "Business opportunities between Slovenia and Poland", some best practices in business collaboration, Slovenian tourist and sports attractions will be shown, which will be followed by B2B meetings of Slovenian and Polish delegation representatives.

During the event "Day of Investment Opportunities" the presentations of investment opportunities in Slovenia and Poland, the Warsaw Stock Exchange (WSE), international business-investor programs of VZMD and best practices and opportunities for business collaboration will take place. The event will be concluded with a business lunch which will be sponsored by the Slovenian Minster of the Economic Development and Technology.

PARIS - the highest representatives of European investors' associations were very interested in hearing the in-depth presentation by Mr. Kotnik and Mr. Verbič regarding the 'bail-in' procedures in the EU, and were extremely surprised by the unique and rad

The presentation "Bail-in: How far does it have to go?", which was delivered in the General meeting of the European Federation of Investors and Financial Services Users (BetterFinance) at the eminent Parisian Cercle de l'Union Interalliee by the member of the VZMD Expert Council, Mr. Tadej Kotnik, and the VZMD President and a member of the BetterFinance Executive Board, Mr. Kristjan Verbič, was met with great interest from the highest representatives of investors' associations from 16 EU member states and many other prominent participants. Due to the interest, wonderment, and many questions, the presentation - instead of planned 20 minutes - took more than an hour and was met with overwhelming approval and applause, and the discussion went on into the evening's informal gathering and gala dinner.

The majority of investors' associations representatives from the Western Europe countries - before the presentation of clear evidence and irrefutable arguments - first expressed their outright disbelief that such expropriation as occurred in the Republic of Slovenia - the expropriation without a compensation, based on secret valuations, inconsistent with the IAS and IFRS standards, and on top of it, with no lawsuit allowed - is actually possible anywhere in the EU, let alone in a euro area member state! Mr. Kotnik and Mr. Verbič have comprehensively and thoroughly exhibited activities and procedures pertaining to the scandalous expropriation of the shareholders and bondholders of Slovenian banks, including the recent developments before the Grand Chamber of the European Court of Justice in Luxembourg. There they drew convincing and documented comparisons of the unique developments in Slovenia with the cases from Austria, Cyprus, Greece, Ireland, Italy, the Netherlands, Portugal and Spain.

Otherwise, the VZMD President had also talked about the mentioned issues in a longer interview on Sunday's 3rd program of TV Slovenia (VIDEO), before he attended the meeting of the Executive Board of BetterFinance in Paris, where numerous topical issues, which are also relevant to the Slovenian capital market and its stakeholders, were addressed, and also about procedures related to the "Volkswagen scandal" as well as the protection of the affected investors, shareholders and users, and potentially suppliers as well, which VZMD has been advocating.

PARIS - in the General meeting of the European Federation of Investors, Mr. Kotnik and Mr. Verbič acquainted prominent international participants with the scandalous expropriation of shareholders and bondholders of Slovenian banks, activities and endeavor

The meeting of the Executive Board of BetterFinance was followed by the General meeting, where Mr. Tadej Kotnik, a member of the the VZMD Expert Council, joined the VZMD President. Following a proposal of VZMD, one of the key issues of this General meeting was also the »Bail-in« of EU banks, whereby alongside recent cases in Italy particular attention was

paid to the unique case of expropriations in Slovenia.

As part of the General meeting, the VZMD representatives presented details of the events and procedures pertaining to the case of the scandalous expropriation of shareholders and bondholders of Slovenian banks, including the recent developments before the Grand Chamber of the European Court of Justice in Luxembourg.

As part of the General meeting, the VZMD representatives presented details of the events and procedures pertaining to the case of the scandalous expropriation of shareholders and bondholders of Slovenian banks, including the recent developments before the Grand Chamber of the European Court of Justice in Luxembourg.

The VZMD President described the mentioned issues also in the Sunday night's longer interview, broadcasted on the 3rd programme of TV Slovenia (VIDEO).