Following last evening's news reports on National TV (RTV SLO) which gained data on the transfer of bad (also many good) debts of the NLB bank to the Bank Assets Management Company (DUTB), it has been reaffirmed that, during restructuring and simultaneous expropriation of share and subordinated bond holders in six Slovenian banks using 5 billion euros of taxpayers' money, numerous outrageous irregularities were uncovered, which also indicate a clearly obvious intent. It follows from the reports on RTV SLO and other media outlets that the Bank of Slovenia required transfers of a number of additional debts including those that were not actually bad - which even had A and B credit ratings just before "findings" were reached at NLB!

News

EXCLUSIVE VIDEO REPORT from the meeting of the Committee of the Slovenian National Council which unanimously took VZMD’s side after facing off with the Securities Market Agency (ATVP) and the Ministry of Finance regarding the disputable Article 25 of the

The Committee of the National Council of the Republic of Slovenia for the economy, craft industry, tourism and finance also invited PanSlovenian Investors' & Shareholders' Association (VZMD) and representatives of the Securities Market Agency (ATVP) and Ministry of Finance to its 66th meeting. After a lively debate and confrontation of opinions and arguments (VIDEO) between the VZMD President, Mr. Kristjan Verbič, and the ATVP representatives, Mr. Primož Pinoza and Mr. Žiga Kosi, and the Ministry of Finance representative Mr. Aleš Butala, members of the National Council favored the arguments and viewpoints of VZMD and unanimously (8 : 0) signed off the proposal for amendments to the Financial Instruments Act (ZTFI-G), with the exception of the bill or amendments to Article 255 of ZTFI respectively, about which VZMD and the European Federation of Investors and Financial Services Users (Better Finance) - ever since the motion has been filed by the Government of the Republic of Slovenia - have warned that it is expressly in opposition to the Regulation 909/2014 909/2014 of the European Parliament and Council, general Slovenian laws and interests of minority shareholders and investors on the Slovenian capital market.

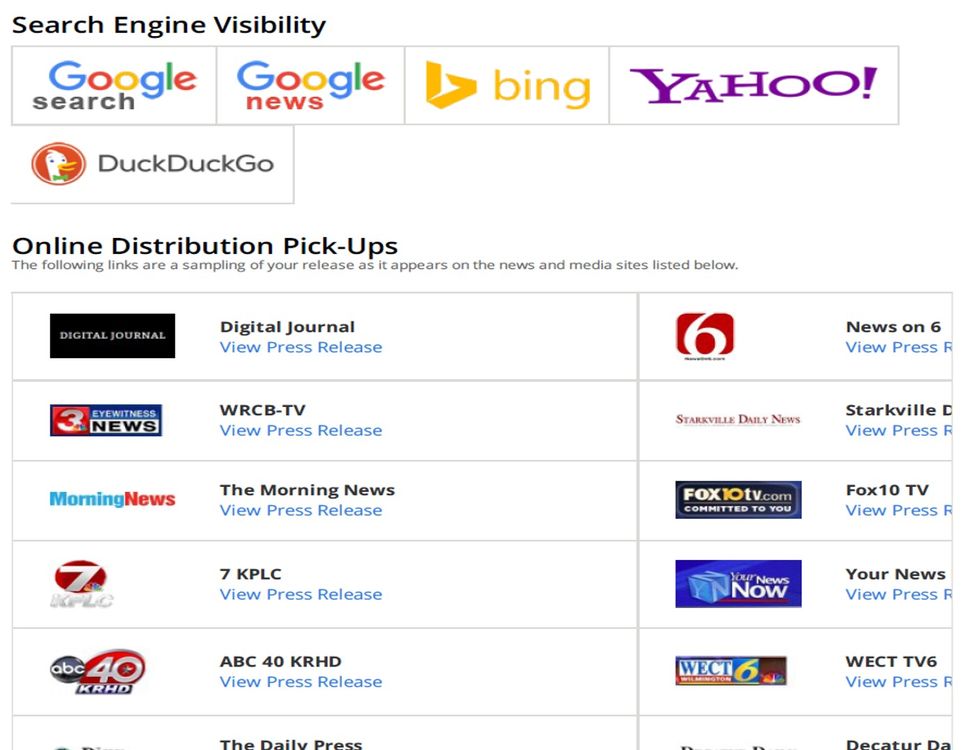

Attempt of the Slovenian Government to block the VZMD's “Share SUPPORT” and incur damage for 117,000 investors through the amending act to ZTFI-G thus opposing the EU regulation - reported by over 200 reputable foreign news media

The open letter recently sent by the European Federation of Investors and Financial Services Users (Better Finance), staunchly supporting VZMD and "Share SUPPORT" in opposing to the government proposal of the amending act to the Financial Instruments Act (ZTFI-G), was subject to reporting by over 200 European and American news media. On Wednesday, the PanSlovenian Investors' & Shareholders' Association (VZMD) warned about the mentioned problem also via the portal https://vzmd.newswire.com/ designed for informing international audiences and news media.

Presenting arguments against the additional amendments to Article 255 of the Financial Instruments Act, aimed solely at disabling the “Share SUPPORT” at VZMD - meeting with NSi party representatives

Individual political parties and deputy groups have responded to the letter of the VZMD President, Mr. Kristjan Verbič, who has sent it last week to the Speaker of the National Assembly of the Republic of Slovenia, presidents of parliamentary parties and leaders of deputy groups containing substantiated warnings and an appeal in view of the Bill on amending Financial Instruments Act (ZTFI-G). A meeting with representatives of the political party "Nova Slovenija – krščanski demokrati (NSi)", attended by the leader of the deputy group, Mr. Matej Tonin, the party's Secretary general, Mr. Robert Ilc, and the President of the Economic Club, Mr. Pavel Reberc, took place yesterday where the attendees listened to the arguments of the PanSlovenian Investors' & Shareholders' Association (VZMD) which firmly opposes the amendment to Article 255 of the ZTFI with the additional paragraph 10. The NSi representatives showed their understanding for VZMD's arguments and made sure that they would thoroughly examine them and state their position in the next meeting of their deputy group.

VOLKSWAGEN - in view of the news and investigations in the U.S., even by FBI, VZMD has again invited the investors to take part in the proceedings within the framework of the World Federation of Investors, the International Financial Litigation Network a

The World Federation of Investors (WFI), whose active member is also the PanSlovenian Investors’ & Shareholders’ Association (VZMD), has announced news regarding the damages inflicted to investors in Volkswagen. The American Federal Bureau of Investigation (FBI) has arrested an executive of Volkswagen and accused him of conspiracy to defraud the U.S., which implies the intensification of the criminal investigation of fraud committed by the car manufacturer in terms of diesel motor emissions. Mr. Oliver Schmidt, who was the compliance manager for Volkswagen in the U.S. from the summer of 2014 to March 2015, was arrested by the investigators in Florida at the beginning of the month.

European Federation of Investors sent out an open letter to members of the National Assembly and the Prime Minister as well as responsible persons at the European Commission - warnings and explicit support for VZMD and the “Share SUPPORT” in opposition to

Immediately after yesterday's meeting of the Executive Board, the European Federation of Investors and Financial Services Users (Better Finance) drafted and sent out an open letter firmly supporting the PanSlovenian Investors` & Shareholders` Association (VZMD) and "Share SUPPORT" in the opposition to the proposal of the amending act to Financial Instruments Act (ZTFI-G), adopted by the Government of the Republic of Slovenia at its session on 5 January and sent for reading to the National Assembly of the Republic of Slovenia by way of summary procedure. The letter from Better Finance was, in addition to the members of the National Assembly, sent out also to the Slovenian Prime Minister, Mr. Miro Cerar, director of the Directorate-General for Financial Stability, Financial Services and Capital Markets Union (FISMA), Mr. Ugo Bassi, and Head of the Securities Markets Unit at FISMA, Mr. Tilman Lueder. In this regard, today Better Finance also sent out a public announcement, which was received besides media and business audience and relevant European and financial institutions, also by the members of the European Parliament.

BRUSSELS - after the Executive Board meeting, also the European Federation of Investors and Financial Services Users staunchly stood up for the Share SUPPORT and VZMD - a letter to members of the National Assembly and Prime Minister of the Republic of Slo

Brussels was yesterday a venue of the important meeting of the Executive Board of the European Federation of Investors and Financial Services Users (Better Finance), which, in the capacity of a member, - besides representatives of investors' and shareholders' associations from Denmark, France, Iceland, Luxembourg, Germany, Spain, Sweden and United Kingdom - was also attended by the VZMD President, Mr. Kristjan Verbič. The central part of the agenda was the medium-term strategy, adoption of the budget including determination of additional financing resources, discussion about the personnel reinforcement and future investors conferences and expertise.

NATIONAL ASSEMBLY - VZMD’s serious warnings regarding the Government’s proposal to amendment the Financial Instruments Market Act exclusively aimed at destructing the »Share SUPPORT« based on unrelenting pressures and narrow interests of the financial ind

The PanSlovenian Investors' & Shareholders' Association (VZMD) President, Mr. Kristjan Verbič, sent the Speaker of the National Assembly, presidents of parliamentary parties and leaders of deputy groups a letter with substantiated warnings and an appeal in view of the Bill on amending Financial Instruments Market Act (ZTFI-G), as adopted by the Government of the Republic of Slovenia at its last session on 5 January and sent for reading to the National Assembly by way of summary procedure today. Furthermore, in its accompanying press release, the Government of the Republic of Slovenia communicated that one of the main goals of the amending act would be "to eliminate identified deficiencies and inconsistencies of the applicable Financial Instruments Market Act".

Urgent notice for the general public about the Slovenian Securities Market Agency (ATVP) and the manner in which it is managed by Mr. Miloš Čas, and before law amendments passed solely to abolish the “Share SUPPORT” at VZMD and options to preserve the in

After disgracing itself for poor supervision of Moja delnica d.d., where a gaping hole broke, after disgracing itself for postponing to publish the price sensitive information about the Panasonic's due diligence of Gorenje d.d. and scandalous approval of the tycoon takeover of Mlinotest d.d., (which is why VZMD initiated legal proceedings against ATVP before the Administrative Court), and after disgracing itself at the National Assembly of the Republic of Slovenia for espousing higher charges in the financial industry, ATVP managed by Mr. Miloš Čas, has proceeded with its crusade and a merciless campaign against anyone who does not bow to the narrow interests of financial moguls by whom the ATVP is financed.

EUROPEAN BANKING AUTHORITY - uniquely radical expropriations in Slovenian banks presented as an excess without comparison at the EBA meeting in London

While preparing for the recent legal actions for damages due to expropriations in Slovenian banks, the problem of expropriated investors was, beside the PanSlovenian Investors' & Shareholders' Association (VZMD) team, also addressed in detail by the European Federation of Investors and Financial Services Users (Better Finance). The Better Finance Managing Director, Mr. Guillaume Prache, presented the actual implementation of the bail-in rules in case of Slovenian banks at the Banking Stakeholder Group meeting at the European Banking Authority (EBA) on December 8 in London. He especially made reference to the individual and retail investors, who didn't have any opportunity for damages since the expropriation nor any opportunity for legal remedies against the total expropriation.

WIESBADEN, GERMANY - conclusion of this year’s 12th tour of international business-investor programs of VZMD with the emphasis on Frankfurt and London stock exchange merger and new appeal to the affected in the Volkswagen scandal

The Meeting of European Federation of Investors and Financial Services Users (Better Finance) and the 10th International Investors' Conference ended in Wiesbaden on Tuesday night. Over 120 prominent guests and highest representatives of companies and institutions in the field of capital markets and finance attended the presentation on the Volkswagen case as well as the compensation claims of investors against the company and persons responsible. Procedures and different options were presented by renowned lawyers Mrs. Deborah Sturman from the New York law firm Sturman LLC, Mr. Larry Sucharow from the New York law firm Labaton Sucharow LLC, Mr. Anatoli van der Krans from the New York law firm Bernstein Litowitz Berger & Grossmann LLP, and Mrs. Daniela A. Bergdolt, Vice-President and lawyer of the German association of shareholders and investors (DSW).