Urgent Meeting of the Commission for Public Finance Control

National Assembly of the Republic of Slovenia

17th February 2015

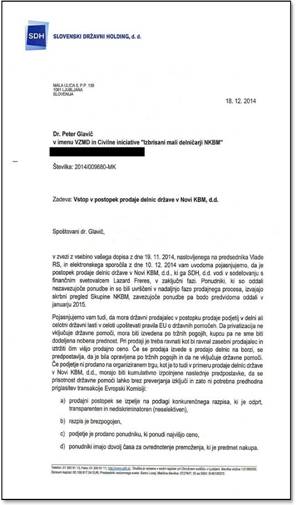

February was largely marked by disclosures by Mr. Tadej Kotnik, member of the PanSlovenian Shareholders` Association (VZMD) Expert Council and first signatory of the VZMD constitutional initiative (VIDEO), which brought about the resounding emergency meeting of the Commission for Public Finance Control, where together with Mr. Kotnik, it was also the VZMD President, Mr. Kristjan Verbič, to have actively participated, as well as Mr. Miha Kunič attorney of VZMD and expropriated holders of bonds - OVERVIEW VIDEO of the VZMD.tv team / investo.TV. The latter - witnessing the continuation of pretended ignorance and misleading statements of some key protagonists - produced an additional particularly revealing VIDEO CONFRONTATION supported by arguments whereby they also disclose many misleading statements by representatives of Bank of Slovenia, of the previous Slovenian government and of protagonists of the dubious bank rehabilitation alongside with the mass expropriation of citizens and dreadful damage to the taxpayers.

Mr. ANDREJ ŠIRCELJ (Chairman of the Commission for Public Finance Control of the National Assembly of the Republic of Slovenia): And why is there such disparity? As far as I know, there was a disparity in assessments of two agencies amounting to EUR 1.5 billion, or something like that. I mean, excuse me, EUR 1.5 billion. In assessing the equity of the banks, guarantees and so on, there was a discrepancy between two auditing companies that amounted to EUR 1.5 billion and according to my information, you used the lower result, it was a lower equity value and you used it automatically, you did not even check. I don't know whether you have checked or not, as far as I know, you haven't.

Mr. BOŠTJAN JAZBEC (Governor of the Bank of Slovenia): The answers to these questions and this is also the reply to Mr. Vrtovec (NSi Party), will be provided in the report we are preparing upon the request of the National Assembly as stated at its session on 26 January and I kindly ask you to give us the possibility to prepare this report, so you will be able to read it and then we will be able to debate on the matters you are opening today and which you would like to discuss in an extraordinary session. It's only 14 days until 2 or 3 March, when this report will be drafted.

Mr. ŠIRCELJ: Mrs. Alenka Bratušek go ahead, it's your turn for discussion.

Mrs. ALENKA BRATUŠEK (President of ZaAB Party, former Prime Minister of the Republic of Slovenia): I'll start with a question to Mr. Kotnik (VZMD Expert Council). What would have happened with Slovenian banks in Slovenia if they had not been recapitalized then with the taxpayers' money? I can tell you that they would have gone bankrupt. Moreover, what would happen to the owners of subordinated bonds, if the banks went bankrupt? They would lose everything. However, I want to hear from you whether these arguments hold up.

Mr. TADEJ KOTNIK (member of the Expert Council of PanSlovenian Shareholders' Association – VZMD): First, I would like to answer to Mrs. Bratušek. I could answer with a question back to you, and I note that these constant threats were a basic approach of your government at the time you were enforcing this wipe-out. You kept saying "If things had not been done our way, the Slovenia would have collapsed" etc. Can you name a single largest bank in any EU Member State at any time in the history of the EU for which the EC required a bankruptcy? But let us assume that they would so require. The next question would be, on the basis of which legal act of the EU could EC require a bankruptcy? Consider that our state paid its own money, in contrast to the situations where a country is receiving a financial aid from the troika and the EU thus sways more power. If we disregarded the Banking Communication of the EC, i.e., if we recapitalized banks back then without first securing an approval of the EC, or even with the EC issuing a negative opinion, EC would still not have any legal basis to order a bankruptcy of any of our banks, as in our country only courts have the legal power to do so. The EC could bring an action before the Court of Justice of the EU in Luxembourg and hypothetically, if they were to win the case, Slovenia would have to pay a fine. I had this conversation with Mr. Čemažar from Bank of Slovenia and together we came to this conclusion: in the worst case scenario, the maximum fee would be about EUR 51 million, in case Slovenia lost. But according to the judicial practice of the Court of Justice of the EU, an action of the EC against a member state due to the state's failure to comply with one of the EC communications was never upheld. If we refer to the Treaty on the Functioning of the EU, it becomes very clear why. Article 288 of the Treaty defines all the legal acts of the EU, it contains the list of EU legal acts and they are as follows: regulation, directive, decision, recommendation and opinion. Then this Article further states that directives, regulations and decisions are binding, while recommendations and opinions are not binding. Communications are not even mentioned in that list. Would you please listen to me Mrs. Bratušek? I am answering your question ...

Mrs. BRATUŠEK: You are not answering the question.

Mr. KOTNIK: Yes I am ... let's continue. In the Official Journal of the EU, communications are not even published within the section L, where legal acts are published; communications are published within the section C. So far, the EC tried three times - I do not know why - but it tried to sue a Member State due to failure to comply with communication and it has lost each and every time, with the Court of Justice of the EU instructing it that communications are not legally binding, they are only guidelines for good practice. You can check this in the court's decisions - one is C-70/06 versus Portugal, the key statement is in the Paragraph 34, the second is C-369/07 versus Greece – Paragraph 112, the third is C-270/11 versus Sweden, Paragraph 41. I don't want to get too philosophical here, but I was telling you all this during the process of preparations for the wipe-out, yet I was completely ignored, no one cared about these facts. I also owe a reply to Mr. Dragonja (State Secretary at the Ministry of Finance). He denies that it was promised to the Ministry of Finance that the equity will be calculated to be negative, says that this was not a binding commitment. However, Mr. Dragonja, the Ministry of Finance has itself submitted last year on 4 February this correspondence between Mr. Mavko (then State Secretary at the Ministry of Finance, now EBRD & Slovenian Bank Assets Management Company) and Mr. Dupont (the C-5 team member of the EC DG COMP) to the Constitutional Court as evidence that the EC has requested a wipe-out and that you therefore had to accept that. So that now I don't understand this. And a reply to Mr. Jazbec. The liquidation value is the one that has to be taken into account simply because you chose to write so into the slovenian Banking Act. I checked the complete Banking Communication looking for a reference to liquidation value, and there is no mention at all in these guidelines, i.e., in the Banking Communication of 1 August 2013 it is not mentioned at all that it is the liquidation value that should be considered. This is written in our law and, I think we can say this openly, we had a conversation some time ago in which we together came to the conclusion that we really had written this law, now I speak in first person even though I had nothing to do with it, but in Slovenia, we had written the law this way so that effectively nothing else than a wipe-out of the subordinated debt can be performed. So I would kindly ask you to confirm that we had this conversation and that we came to this conclusion. Thank you.

Mr. JAZBEC: Answer to Mr. Kotnik. We talked several times and several times, if you allow me we may also continue on familiar terms as we always do, we have discussed a lot on many topics and today you have quoted a couple of times, really, probably you read the reports about the subject of the conversation. And on 17 April 2014 I replied to you in writing: "Tadej (Mr. Kotnik), we are officially in a legal proceeding, therefore I will stop to communicate with you, because I don't trust you. Best regards Boštjan." I don't know if a message may be used as evidence because the messages may be also manipulated and falsified, but it's all I have. Nonetheless, I can confirm that we also discussed the argument you questioned me about. To Mr. Verbič (VZMD President): we are disclosing everything in the courts, even that which cannot be disclosed in public, and therefore your statement that we did not disclose, is wrong. At the Constitutional Court, all decisions about our measures are disclosed.

Mr. KRISTJAN VERBIČ (VZMD President): With regard to the question of data accessibility and "disclosing everything in the courts", as you mention it, honorable Governor (Mr. Jazbec), let me say only that we did not have any access, since they are of course in the classified part of the court files, and if you allow me I would ask our lawyer for an explanation with the exact legal definition and terminology.

Lawyer MIHA KUNIČ (representative of VZMD and holders of subordinated bonds): Yes, in short, the Ministry of Finance and the Bank of Slovenia have requested that all documents be presented as confidential and that before the Constitutional Court, an internal part of the file would be created. On 30 May 2014, we addressed a request to access these files and the Constitutional Court has partially obliged, which implies that probably your legal department illegally requested that these files should be considered confidential, because the Constitutional Court itself already released a number of documents. Yet, we still do not know how much remains a part of those files still classified and what is therein.

Mr. JAZBEC: Yes, it is true that no one can replicate these methodologies because of the information he lacks. These data are the data that bind the Bank of Slovenia to confidentiality because this follows from the Banking Act.

Mr. VERBIČ: There is much talk about the need to implement and follow the law, but on the other hand, in contrast we hear Governor's claims that they (Bank of Slovenia) are in the grip of the law on public information and public access to public information, in the grip, and are reluctant to reveal the crucial point. So why are those frames not disclosed, and when you are talking about, of course, that external institutions were carrying out these checks and came to these findings, shouldn't you disclose, especially when it comes to taxpayers' money, under what conditions? What are the conditions in the contracts with external institutions? Why so many audits and procedures were needed, until finally they found that there was supposedly just as much negative equity that the complete expropriation could be done.

Mr. ŠIRCELJ: Was the wipe-out justified or something else could have been done as, for example, to exchange these securities into ordinary shares, I am not giving solutions now or anything, but was all this really unavoidable?

Mrs. BRATUŠEK: Once again I want to say that without the wipe-out of subordinated bonds, the restructuring of the banking system would have cost every Slovenian 300 Euro more. However, once again I will say that the option to choose or decide either way, anyway, we did not have at all.

Mr. VERBIČ: The problem is precisely the fact that the bondholders were not offered the possibility to participate in the capital increase, even those who might possibly have been converted from subordinated bonds into the shares, did not have this option. Were they invited at all, and would this be in accordance with the law, of course? While talking about the implementation of the amendment to the Banking Act, yes of course, it was all done in accordance with the amendments to the Banking Act, but the latter was written for exactly this purpose and again, but not surprisingly, a quite significant fact that there was just as much negative equity found in banks, that the expropriation of all holders of both shares and subordinated bonds was justified. Just enough!

Mr. UROŠ ČUFER (former Minister of Finance of the Republic of Slovenia): But to me, however, this initiative was actually close, to seek a compromise proposal, and if the opinion of this committee which exercises the control over public finances is that this would not be an abuse of taxpayers' money, in order to seek a compromise proposal, I would, if I were still minister, also follow this path and would ponder upon the possibilities to look for a compensation in terms of participations in the profits, perhaps of our bad bank or something of this kind.

JANEZ JANŠA (SDS Party Chairman): After that, I phoned somebody I knew at the European Commission and I asked him whether this was really a requirement set by the European Commission. And he told me that the requirement was, certainly, that the holders of subordinated financial instruments bear the burden proportionately, but that the wipe-out was not expected and that they did not require this of anyone.

Mr. VERBIČ: Important international funds have been strongly surprised and dismayed with that what happened. We were able to monitor all these discussions in the international arena directly on behalf of our association and they all were amazed, including at the level of the European Parliament, the European Commission representatives, with whom we had contacts, by the continuous indications that such kind or pressure was exerted or requirements made by their officials.

Mrs. BRATUŠEK: It is not correct that we are deceiving, you are deceiving Slovenian taxpayers, that if it is written in a document that it is only a Communication, that it should be viewed simply as Commission's desires that can be ignored.

Mr. MATEJ TONIN (Chairman of the Parliamentary Group of NSi Party): I'm not a lawyer, but we had among the courses at the Faculty also the Law and there we were taught, I do not know if this is still true, that the only legally binding documents of the European Union were directives and regulations, but not communications.

Lawyer KUNIČ: Several facts. The Constitutional Court in its order dated 06 November 2014 has already stated that the way our Banking Act was amended interfered with the constitution and indicated the possibility that holders of subordinated bonds may succeed with their constitutional initiative presented to the Constitutional Court. This is the first fact. Another fact is that I have to agree with Mr. Arhar (Director of the Bank Association of Slovenia); the EC Banking Communication of 30 July 2013 is only a useful tool, an internal act of the Commission. The case law of the Court of the EU is crystal clear; this is not a binding legal source at all. In the case that an aid would be granted, if a dispute would arise, it would be judged under the EU directives. If I make an analogy, the tax authority of the Republic of Slovenia has its internal rules that everybody must comply with, but it is only a tool for concerted action in a big body; in the event of a legal dispute, the law would be followed, not internal acts. The same applies, having the same weight, to a Communication in the case law of the Court. Which means that exactly this issue was addressed by the Constitutional Court to the European Court of Justice (in Luxembourg), but we must not forget that in a number of case-law decisions of the Court for Human Rights in Strasbourg has already stated: "Hereby, what is assessed is always the compliance with human rights, as enshrined in the Treaty on the Functioning of the EU, and this will determine the court's final decision." In short, actually there are procedures running before the administrative court and also before the Constitutional Court. Civil judicial procedures have not yet been opened. Why? Since there is a kind of waiting for the procedures of the Constitutional Court to come to an end, but given the nature of the case we will eventually come to the very limit, which means that the Slovenian ordinary courts may face additional lawsuits for 600 million euro of compensation. And you should be aware also of the following fact: if the holders of subordinated bonds do not establish claims back to the bank, the statutory default interests will start to accrue as of a given date.

Mr. ARHAR (Director of the Bank Association of Slovenia): If the domestic Banking Act were not changed, we would not have been forced to do anything solely on the basis of the decision of the EU. The EU does not interfere in such manner with the authorities and we have been discussing this change in domestic legislation. Professor Kotnik also mentioned it earlier. Our opinion on the prepared legislation was negative. Why was it negative? Because we were aware of, if you remember, in March 2013, the actions in Cyprus. What was happening in Cyprus? The result was fear, even renewed speculations on the fate of the euro. The withdrawals of funds started and so on. When talking about money, the first and the last word is "trust."

Mr. JAZBEC: The first accusation that we forged documents; you would probably require someone to present a document that was supposed to be counterfeited and to attach the original document.

Mr. KOTNIK: There are writings about counterfeiting or forgery. I've never used these terms, which represent an offense under our Criminal Code (KZ 1). What I used were the terms distortion and manipulation. This is not necessarily a criminal offense in KZ 1, it is a milder form.

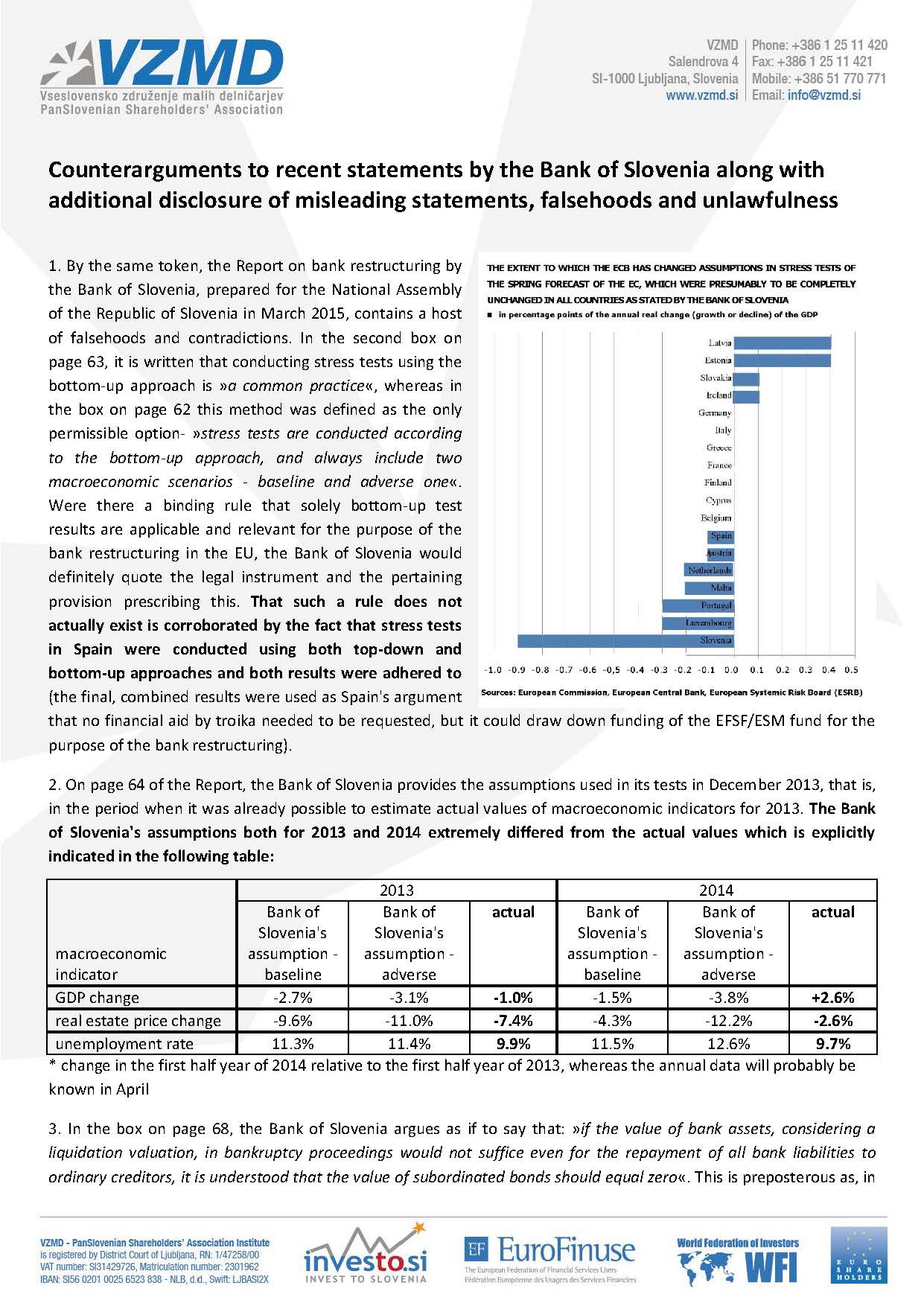

Mr. JAZBEC: The allegation that Slovenia has been treated worse than other countries stems from the fact that the economic situation in 2012 and 2013 was worse than in other countries. And the negotiations on individual issues were held on a daily basis, therefore I can hardly understand the complaint that there was any kind of change in the methodologies, that now some of you want to polemicize.

Mr. KOTNIK: Are some pretending to be ignorant here!? I do not know. One of my sources from the Bank of Slovenia told me on 28 October 2013, and I quote: "The methodology is negotiated every day, and from EC they continuously exert the pressure and will not let it pass unless the equity is all negative and a complete wipe-out is performed," unquote. As a proof, I propose that the National Assembly or an eventual committee of inquiry obtain the files of the stress tests evaluations from that period and with the equity calculations, both for the operating company (going concern) as well as for non-operating company (orderly liquidation). You should obtain all successive working versions of these files, how they have evolved between 15 August 2013 and 12 December 2013 included. Now, the Bank of Slovenia may probably claim that these intermediate files do not exist, that the equity was calculated only once, on 12 December 2013, but this is not true. These simulations were running for at least two months, changing daily weakening ratios for various assets. Therefore, once again, you should obtain these intermediate data files from the Bank of Slovenia. It would be advisable to obtain them independently from the evaluators themselves, the best thing would be to do it right now. Let me quote the Governor again: "Methodology and assumptions are subject to everyday negotiations and adjustments." And these adjustments, if I am now very exact, were held until 9 December 2013 morning. On that day, the value of one of the capital buffers was finally fixed, they changed it by hundreds of millions of euros. It was an agreement, concluded on that day between the Bank of Slovenia and the asset reviewing companies. You should verify this at the Bank of Slovenia, as additional evidence that the Bank of Slovenia actually had a significant impact on the methodology and that on 9 December morning, it changed it substantially. By this, the sixth link in this chain was fixed, determining the final methodology. After four months of daily negotiations and adjustments, the companies Deloitte, Roland Berger, Ernst & Young and Oliver Wyman launched a final round of calculations on 12 December 2013 and in all banks they found equity to be negative enough, here is one such graphic circulating, so, negative enough to wipe out all subordinated bonds of all classes everywhere and anywhere, in sharp contrast to the strongly positive equity in accordance with the International Accounting Standards, as reported on the same day by those banks. All of this because the promise of the restructuring plans was already made and therefore it had to be fulfilled, as it was given in writing.

Mr. JAZBEC: The most frequent accusation to the Bank of Slovenia is that it did not publish the methodologies. They are available on the website of the Bank of Slovenia and anyone with access to the Internet may easily access this data and methodologies' reviews.

Mr. LUKA MESEC (Head of the Parliamentary Group of ZL Party): On your web pages, very patchy, censored methodologies are published and certainly not the data on how this methodology changed over time. To quote the economist Jože P. Damjan, this publication of yours was a definition of emptiness.

Mr. JAZBEC: Were Slovenian banks in this whole process overcapitalized or Slovenian banks have too much money or we Slovenian taxpayers have paid more money? Changes in the capital adequacy ratio show that Slovenian banks were over the whole period from 2008 onwards less adequately capitalized than the average of the EU and the euro area, and the data are not exclusive data of the Bank of Slovenia, but are official data of the ECB. And if you take a look, only with the recapitalization at the end of 2013 we managed to put the Slovenian banks on a comparable level of the average of European banks in the euro area.

Mr. ŠIRCELJ: Deutsche Bank 12.8, Commerce Bank 12.1, Royal Bank of Scotland 8.6, Societe Generale 10 percent, UniCredit 10.57, Raiffeisen 10.10, ... yet Nova Ljubljanska banka 16.60, Nova Kreditna banka Maribor 20.45.

Mr. MESEC: In the Združena levica (United Left Party - ZL), we find that the suspicion is that the stress tests, published in 2013 and October 2014, were carried out implausibly, that the responsibility of the Bank of Slovenia herein is objective, that you concealed the methodology, that you manipulated the data and that therefore, the damages were caused to the bondholders, small shareholders, as well as to the Citizens of the Republic of Slovenia, who have, according to Mr. France Arhar, overpaid the recapitalization of Slovenian banks by 1 to 1.5 billion euros.

Mr. VERBIČ: Indeed, elements appear that we may say that we are facing a plunder of the century. Without any wish to be populistic, but on the basis of actual facts, practices, circumstances. What is the five billion amount in this period, approximately, of invested taxpayers' money in Slovenian banks in the banking system all about? Let's say, that a typical example of that what is happening is the NKBM bank. Recently, we have witnessed that it is being offered for sale for 150, maybe 200 million euros, while we know that this bank, due to its overcapitalization, now stands close to 24 percent capital adequacy, which is much more than 10 percent, which is the average at the level of the EU and which is required. It means that those who would buy the bank, let's say for 200 million euros, would in fact be able, besides owning the bank, to directly and immediately withdraw from it at least 150 million euros approximately. Leaving aside even the government bonds, which will remain in the bank's portfolio and leaving aside the fact that this bank is actually a system, including the Postal Bank as a part of this system, all real estate, all claims. And a similar situation is faced by the entire banking system in the Republic of Slovenia, we are faced with the fact that the taxpayers paid so much, firstly, on basis of the result that was desired - obviously to present the situation as undercapitalized. As a result, they overcapitalized these banks and now these banks are filled, those banks as a complete system are under such conditions. I want to absolutely distance myself from the insinuations related to hindrance of privatization and similar stuff, but nevertheless, here in this particular case and because of this, the association has filed with the Constitutional Court a request for temporary suspension of sales procedures of the NKBM. Why are the sales operations related to the banks also problematic? Because by the sale, and some, of course, strongly wish to hurry with it, but afterwards it will be much more difficult, if possible at all, to get the data, to clarify what was really happening in these banks.

Mrs. BRATUŠEK: And secondly, to Mr. Arhar, I do not know, you've been Governor of the Bank of Slovenia, but in your opinion, could the rules of the European Central Bank, European Commission have been avoided and the help to Slovenian banks been carried out, and, if yes, how?

Mr. ARHAR: I put the same question in Europe, in Brussels. When we talk about state aid, how is State aid to be treated, if I, meaning the State, am the bank's owner? Is this a self-help? In fact, we haven't asked Europe for anything prior to the Communication of 1 August 2013. Over 4 trillion was the total State aid given (throughout EU), in cash, in guarantees and so on. The Belgian KBC, the co-owner of the NLB bank, was a private bank, it received state aid and, of course, with the state aid, commitments and so on. Tell me, what have we got from Europe? What amount of money we got from Europe? I do not know of any. We did not get any amount. Yet we had to commit.

Mr. ŠIRCELJ: I am opening the vote…

Mr. VERBIČ: Well, we can rarely see such homogeny in the National Assembly and in politics. It makes me pleased, especially because I think that the civil society, and particularly our association (VZMD), prepared very precisely and carefully the arguments, the evidence, and I thank you for the opportunity to present them to the Commission for Public Finance Control of the National Assembly and to meet here the representatives of the Bank of Slovenia and the Ministry of Finance. Considering the fact that all the decisions proposed were also adopted, it fills us with hope that in a reasonable time, which means as soon as possible, the situation in the Slovenian banking system will normalize, with taxpayers and particularly those who have been double-hit here, I mean the expropriated persons, will get back what belongs to them. In any case, we are doing this in order to achieve what is right, and to reach the justice for the interests of expropriated bondholders and shareholders does not only represent the care solely for their interests. In this case, it is a concern in the interest of all taxpayers and citizens, last but not least because the functioning of banking and related operability of the whole economic system in the Republic of Slovenia are needed to assure a perspective for the country and also for future generations.

Last week the Slovenian business delegation returned from a handball colored Doha, where after five intensive days, the official part of events was concluded with a

Last week the Slovenian business delegation returned from a handball colored Doha, where after five intensive days, the official part of events was concluded with a collaboration

collaboration On Sunday, President Verbič also attended

On Sunday, President Verbič also attended